Introduction

In the present context, which is marked by the gradual shrinkage of regular and conventional media and arrival of digital media, tourism industry is undergoing a rapid transformation. Digital media has become very significant for the travel and tourism industry. It plays a very crucial role in the entire cycle, a traveler undergoes-selection, planning, information gathering, booking, and visit. The following table gives a list of e-marketing activities corresponding to various stages of travel. (Nguyen N, 2007)

Table 1: shows the e-marketing activities corresponding to various stages of travel.

In order to up their ante in this transformed tourism landscape, it is essential for tourist destinations to have a strong presence across various web platforms- travel websites, social media, social media, and mobile application etc. The following report will analyze the online brand strength of leading tourist destinations from Asia- Hong Kong, Singapore, Bangkok, Dubai and Istanbul. It will do a comparative analysis of the online brand presence across the following platforms- search engines (Yahoo and Google), travel websites (Trip Advisor, Frommer, Virtual Tourist, official tourist websites) and social media (Face Book and You Tube) etc.

Search engines

Search engines play a vital role in any form of marketing. The following part provides a simple estimate of search results related to the five locations in Google and Yahoo, two of search engine giants.

Fig 2: shows the image search results in millions for the five destination in Yahoo & Google

Fig 3: shows the image search results in millions for the five destination in Yahoo & Google

Fig 4: shows the video search results in millions for the five destination in Yahoo & Google

Fig 5: shows the number of search engine results in millions on typing- name of the destination followed by hotels. Exp: Singapore Hotels

Fig6: shows search results in million in Google and Yahoo on typing places to visit. For exp: Hong Kong places to visit.

Official tourist websites

Websites are the representation of the tourist destinations in the web world. Not only do they build the brand image of the destination but also guide unaware tourist by providing all the relevant information in detail. It helps traveler make travelling decision. Some of the essential requirements of travelers are- direction information/map, visa and policy information, local information, photo gallery, multilingual functions, content categorization, multimedia functions, utility functions etc. (Quan Z, Rich D, 2005) Out of all the available websites, the role of an official website is always much more significant, since it represents the official view point. The given part of the report intents to analyze the popularity of official tourist websites of the five destinations both In terms of web analytics as well as qualitative aspects of the website. For web analytics measurement double click ad planner will be used.

Official Websites of tourist destination

Fig 7: shows the total unique visits and page views for the five official sites, over the month of November 2011. The column chart shows unique visits, where as the line graph shows the page views. Source: double click ad planner.

Fig 8: shows the average time spent by a visitor in minutes: seconds. Source: double click ad planner

Table 2: compares the home page of the five official websites across some of the basic parameters.

. Table 3: compares the home page of the five official websites across some of the advanced parameters

In terms of unique visitors and total page views, discover Hong Kong has an insurmountable lead over others. This is followed by Singapore; others are far behind. Discover Hong Kong is available in 14 different languages, a unique feature missing in other websites. The closest to this, is Definitely Dubai, which is available in 5 different languages. Other than the multilingual function most of the websites provide all the basic function listed in table 1. It is the advanced parameters which seem to be the differentiating factor. Yours Singapore has all the five features, followed by Hong Kong with four. The other three have three each. All the five websites have designed very attractive website with lot of multimedia works-videos, photos, flash etc. One of the unique features, of the two successful website is availability of geographical customization- provision of custom made packages for different geographies.

Travel websites

Travel websites play a very significant role in tourism marketing and destination branding. Not only do they provide booking facilities for a gamut of tourism activities but also share reviews for tourist destination in the form of – comments, articles, videos and photos. These travel websites are loved by tourism enthusiast and amateur tourists alike and some of them have huge fan following all across the globe. A larger presence in such websites will ensure stronger brand image for destinations. The given part of the report will compare the five destinations across three of the most popular tourism websites- Frommer, Trip Advisor and Virtual tourist

Frommer

Table 4: shows the no. of destination guides, communities and photos for the five destinations in Frommer.

Trip advisor

Table 5: shows the no. of reviews, forums and articles for the five destinations in Trip Advisor.

Virtual tourist

Table 6: shows the no. of tips and reviews, forums and articles for the five destinations in virtual tourist.

With the help of the three tables it could be concluded that none of the destination emerges as a true winner. There is a lot of variability across the three websites. While Frommer and Trip Advisor are dominated by Bangkok; Singapore has stronghold in Virtual Tourist. Even within the sites there are lots of variations. For instance, Istanbul has the 2nd least number of tips & reviews in virtual tourist where as highest number of videos. Another point to be considered is that if there is no winner, there is no loser as well. All the five destinations have substantial presence across the three websites in the form of- reviews, photos, videos, forums and communities.

Facebook

Digital media landscape is transforming, with social media playing a very pivotal role. One of the most popular social media site across the globe is Facebook or FB. FB which is available in more than 70 languages, has more than 800 million active users across the world. More than 50 percentage of active users log on to FB on any given day .On an average, every user is connected to 130 friends and 80 communities, events etc. (Facebook statistics, 2011) with the help of its phenomenal popularity and sheer volume across the globe, FB provides a very vibrant platform for marketers, to communicate and interact with their target customers. It also plays a very prominent role in building brand image for tourist destinations. The given part of the report will compare the brand strength of the five tourist destinations on FB. Since there are many FB pages related to the destinations and comparing all of them not possible; the given analysis will select the most popular page for all the destinations and do a comparison among them.

The pages are:

Dubai: I Love Dubai

Istanbul: Istanbul, tours/ sightseeing

Singapore: YourSingapore

Bangkok: Bangkok, public places

Hong Kong: Hong Kong, Attractions, things to do

Fig 9: shows number of likes and people talking about the given destinations on their FB pages. Source: FB pages

Marketing a destination on FB also requires a lot of activities and updates on the group page, besides just having a page. In order to comprehend the level of activities done on each page, a seven day period- 19th Dec to 25th Dec, has been selected. Under the given period, all the activities- updates, likes, comments and shares have been recorded, as depicted by the following table.

Table 7: shows the number of updates, comments, likes and shares during 19th to 25th Dec, for individual pages of tourist destinations. (Only updates related to tourism has been included)

On FB, Dubai seems to have an edge over other destinations. Its page “I love Dubai” can be considered as one of the best well managed and organized FB page for tourist destination across the globe. Properly moderated, it comes up with regular updates of photos and videos, reflecting the grandiose and extravagance of Dubai. The beautiful photo graphs, attract a large number user likes comments and shares. Other cities which come close to Dubai could be Istanbul and Singapore (YourSingapore). Istanbul like Dubai, is well moderated but is also fraught with lot of irrelevant updates- political spoofs, funny pictures etc. Another flaw for page “Istanbul” could be predominant use of Turkish language, which deprives it of an international appeal. YourSingapore is another well managed page but needs more updates. For the other two, lot needs to be done. Large number of user generated updates, which includes greetings and adieus, contradict with the professional outlook expected out of such pages.

You tube

Another powerful social media tool is “You Tube”. Over 800 million of unique users visit You Tube every month. Over 100 million of users take social actions such as like, share and comment on You Tube every week. (Youtube.com press statistics, 2011) You tube does not only play a pivotal role in branding a tourist destination, but also contains negative perception by interacting directly with the tourists. (Sofia R, Brain H, 2010)

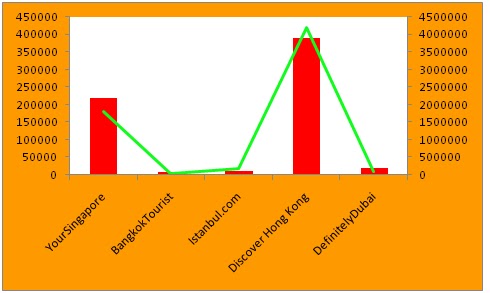

Fig 10: shows the total number of tourism related searches and total views for top 10 searches, for the five destinations. Column chart shows the no. of searches, whereas line chart with data labels show the total no. of views. Source: You Tube

Conclusion and Suggestions

It could be comprehended from various charts and tables that none of the five destinations emerges as a clear cut winner. However, someone close to the numero uno position could Hong Kong, followed by Singapore. Both the city states appear to be comparatively well equipped in building their brand on the web world. Based on the analysis, there are following suggestion, which could help these states further enhance their brand image -

· Bangkok: with an intake of 10.2 million tourists, it is Asia’s most visited city. (enjoyyourholiday.com, 2011). The city also enjoys a high no of user generated reviews, communities, photos and other user generated contents in travel sites such as trip advisor, virtual tourist etc. However it has comparatively lesser web presence as estimated from the search engine section. In the social media segment it has strong base in You Tube, but needs to use Face Book more aptly. It can also work on its website by adding custom made packages.

· Istanbul: is the only city in the globe, stretched across two continents- Asia and Europe. In most of the sections, Istanbul has shown a moderate show, neither too good nor too bad. An area where it needs to put some extra efforts could be You Tube. Another could be official tourist page. The English version (the Turkish version is doing good with 2,00,000 visitors over November 2011) which definitely engaging as reflected from the average time spent, is still not attracting large volume of visitors like its counterpart, Singapore and Hong Kong. One possible measure could be annexing a Russian and German version as Turkey receives quite a good number of tourist arrivals from the two countries.

· Dubai: like Istanbul, Dubai has also showcased moderate performance across most of the sections. One area where it has been exceptional could be FB page “I love Dubai”. With arsenal of spellbinding photographs of Dubai, has been successful in its attempts of engaging and communicating with people. Besides working on platforms like virtual tourists, Dubai can rework on its official tourist site. Adding custom made packages and an Arabic version can help in more traffics.

· Hong Kong and Singapore: are already strong on the web. A simple piece of advice for Hong Kong could be linking social pages with the official tourist website.

Limitations

The given report has some fundamental limitations such as:

· Search engines: based on the keywords, the number of searches give only an approximate estimation of web content available. More ever the total number of searches keeps on varying with time to time.

· Reviews: reviews themselves are not 100 % accurate estimation of the brand presence, since it is not just the numbers but quality of reviews that also matters. More over a negative review can be detrimental to the brand value.

· Google double ad click: the unique visitors, page views and average time spent, calculated by Google double ad click are just estimation rather than the exact data. However out of many website measurement tools available on the internet, it is considered as the most authentic by many web media evangelist.

Reference

1> Nguyen N, 2007,tourism trends and the effect of online booking for Vietnam travel market, available < http://www.findvietnamresorts.com/company/advertise/research.pdf>

2> Quan Z, Rich D, 2005, Usability issue in city tourism websites: content analysis, p-3, available at http://www.arlt-lectures.com/cross-cult-city-tour.pdf

5> Sofia r, Brain H, 2010, the use of you tube as tourism marketing tool, available at < http://eresearch.qmu.ac.uk/2315/1/2315.PDF>

6> Enjoyyourholiday.com, 2011, top 10 visited cities in the world, available at < http://www.enjoyourholiday.com/2011/04/18/top-10-most-visited-cities-in-the-world/>

Fig 1: online brand display image. Source: reactorr.com