Fig 1: Jebel Ali Port in Dubai, Source : Dubai construction updates

The following blog will try analyzing Dubai as a trading zone and Dubai’s potential as a trading hub for some selected items like petroleum, cotton, automobiles etc. It will also do the same for Singapore before comparing the two trading hubs across some selected parameters. Finally it will give some recommendations for Dubai as a trading hub.

Trading Zone

A trade zone/ hub is a port or an area, where imported goods could be held for a while without any custom duty and then can be re exported. Generally doing custom formalities is an arduous task and involves a lot of cost. Hence a trading zone or a free trading zone, (as it is usually referred) helps in cost reduction. Such trading zones are also used by MNCs in establishing their manufacturing units and export units so that they can leverage better production facilities, export facilities, tax benefits etc. Some of the major free trade zones in the world are- Taiwan, Singapore, Dubai, Jamaica, Hong Kong, Miami, Mauritius etc. Following facilities are required in a trading zone:-

Transportation Facilities such as well equipped international sea ports and airports

Strategic geographical location

Telecommunication and IT facilities.

Financial instruments and facilities used for hedging, credit etc.

Institutional support in the form of tax benefits and narrowing down of bureaucratic hassles.

Dubai as a Trading Zone

Dubai is among the leading trading zones in the globe. The Emirate is blessed with an extensive coastline of 400 miles and is linked to 120 destinations across the sea. The main sea port in Dubai- Jebel Ali sea port is the largest man made harbor in the world. Dubai’s strength as a trading zone lies in its- strategic position, positioning as a gateway to Middle East region, state of the art infrastructure and logistic facilities and efficient government machineries. Dubai’s export had been hit hard recently due to global economic recession coupled with real estate crisis. But in 2010, it was back on track, registering a total export and re export of US $ 58.4 billion, against US $ 50 billion in 2009. (Emirates 247.com, 2011) In 2011, so far Dubai had enjoyed an export of US $ 27.2 billion, a 17 percentage increase over the same time period last year. In May alone export had reached US $ 5.9 billion, highest in the past three years. (Khaleej Times, 2011) According to Dubai statistics center, from 2006-10, there had been a total of export of US $ 169 billion. The following pie chart shows the percentage of Dubai's export to various countries in the last five years.

Fig 2 : pie chart showing, the percentage of Dubai's export to various countries. Source of data: Dubai statistics center.

Iran’s ongoing animosity with the Western world makes difficult for it to import from these countries. Hence, Dubai placed, geographically close to Iran makes it an obvious trading partner. The total value of trade between Iran and Dubai, from 2006-10 is valued at US $ 25.7 billion witnessing a compound annual growth rate of 21 %. The second largest trading destination for Dubai is India. India and Dubai shares a strong trading relationship, on account of geographical proximity as well as a huge Indian expatriate population residing in the Emirates. The total value of Dubai’s export to India in the given period had been US $ 18.5 billion witnessing an exorbitant compound annual growth rate of 71 percentages in the given period, mainly on account of surge in export of diamond and gold jewelries to India.

Dubai is also a large Re- Export center. It imports commodities from various countries and ships it to various destinations. After Hong Kong and Singapore, it is the 3rd largest Re-Export center in the world.. Some of the major Re-Export items are machines, tea, coffee beans, automobiles, cottons, textile etc. Major Re Exporting destinations are – Iran, Saudi Arabia, and India etc.

In the coming years trade in Dubai is expected to increase further. Dubai’s economy seems to be recovering very strongly and things are back on track. As a part of the strategic plan 2015, the govt. of Dubai plans to diversify the economy into various alternate sectors and trade is very high up on their agenda. Along with the above mentioned strengths of Dubai, one of the biggest strength of the Emirate is financial and institutional support UAE can provide in the form of strong credit and liquidity.

Table 1: data pertaining to Exports and Re Exports for the year 2010, Source: Dubai Chamber of Commerce Annual Report, 2010

Fig 3: Showing total export (export + re export ) of Dubai. Source: Dubai chamber of commerce annual reports

Advantages of Dubai

· Strategic Location: Dubai’s biggest strength lies in its strategic location- globally, regionally and locally. Globally Dubai is placed between the cross roads of North and South and East and West. Some 3.5 billion populations reside within eight hours of journey from Dubai. Regionally Dubai is considered as the trading hub of the Middle East region along with other adjacent regions such as Mediterranean, Central Asian and Africa. Dubai has strong trading links with the 1.5 Billion people living in the region. It is a distribution hub for a large amount of things such as textiles, packaged food items, automobiles, machine parts etc for the whole Middle East region. Locally Dubai is placed in the midst of , one of the richest regions in the world- the GCC (gulf cooperative council), as result of which it is endowed with abundant supply of energy and capital at an economical cost.

· Ports in Dubai: Jebel Ali Port, world’s largest man made harbor and largest port in Middle East had been constructed in 1970s. Spread across a total area of square 134 KMs, it is the 7th largest port in the world. It is associated with Jebel Ali free trade zone, home to more than 5000 companies from 120 countries. It offers more than one million square meters of container yard and 960,000 square meters of open space. Other than Jebel Ali, another port in Dubai is port Rashid, which will be ultimately developed into a cruise terminal. In 2007 along with port Rashid, the total capacity of Jebel Ali port was- total cargo volume of 130 million tons and container traffic of 10.6 million TEUs. Dubai had a very ambitious plan of expanding the Jebel Ali port. By 2030 it is expected to handle 55 million tons of TEUs. (Container-transportation.com, 2009)

· Air Cargo in Dubai: Dubai is the gateway between the East and West. Dubai international airport is the 5th largest airport in the globe, in terms of cargo capacity and has offices of 35 cargo airlines. After the new airport, Dubai World Central Al Maktoum International (DWC) will be operational ,the overall cargo volume is expected to increase by 48 percentages by 2015. In 2010, with a overall capacity of 2.5 million tons, it handled a cargo volume of 2.2 million tons, up from 1.9 million tons in 2009. Since the advent of its cargo operation in 1991, the cargo operations at Dubai airport had witnessed a phenomenal journey, metamorphosing itself from global ranking of sixty one to top five. From its very beginning the overall throughput was neck to neck with the overall capacity, there by influencing timely capacity expansion. (Khaleej Times, 2010) The following figure shows the capacity of the airport over the last twenty years.

f

Fig 4: showing air cargo volume at Dubai airport over the period of time. Source: Khaleej Times

Institutional Support: -

Dubai provides strong institutional support for export. The Jebel Ali free trade zone is effectively tax free. Companies are not charged with any personal or corporate for the initial fifteen years. After the completion of the initial fifteen years, companies can even request for another fifteen years of tax exemption. Additionally there are no import /export taxes for companies operating in the region. In general, the custom duties are very low at 4 percentages, and there is virtually no, trade barriers , quotas, and restrictions on currencies,enabling Dubai to become a favorable trade destination.

The following part of the blog will put some light on Dubai’s strength as an export/ re export center of some particular items:-

Tea: - off late Dubai is emerging as a strong tea re export center, owing to its geographical proximity with major tea producing nations and excellent ports with state of the art warehousing facilities. There are dedicated ware houses with facilities for blending and packaging of tea. Dubai accounts for around one fourth of global tea imports and re exports, primarily to neighboring Middle Eastern and Central Asian regions. In order to facilitate tea trading, in 2005 DTTC (Dubai tea trading center) had been established by DMCC (Dubai multi commodities center). DTTC managed a total trade of 10.8 million Kg of tea in 2010, up from 7.5 million Kg, in 2009. India, Sri Lanka and Kenya are among the major partners of DTTC and together they account for around 65 percentages of tea trading done through it.

Fig 5: showing the annual trade of tea for DTTC and Dubai as whole in KG millions. (Source: Middle East business intelligence, SME advisor, Khaleej Times)

g

Automobile: - Dubai is the major trading hub of automobiles and other transport equipments in the region. During 2009, on account of the global economic crisis, the overall trading of automobiles was hit hard, but in 2010 the market recovered. In 2010 the overall import and re export of automobiles is valued at US $ 5.45 billion and US $ 2.45 billion respectively. The emergence of Dubai as an automobile trading hub can be attributed to Dubai being a major re export center of automobiles to the MENA region. During the six year period from 2005-10, Dubai’s total import of automobiles is valued at US $ 33.75 billion. Iraq is the biggest re export destination followed by Iran, Libya and Saudi Arabia. Together these countries account for around 41 percentage of Dubai’s re export in the MENA region. In terms of major automobile suppliers to Dubai, Japan contributing 44% of the supplies leads the list, followed by USA, Germany, South Korea and UK. Together these countries constitute 88 % of the total import. (SME adviser, 2011) The following pie chart shows the major automobile exporting countries to Dubai:

Fig 6: major automobile exporting countries to Dubai (Source: Dubai Chamber of Commerce)

Aluminum

A Aluminum is one of the most widely used metals in the various industrial sectors such as engineering, construction, electrical, automobile etc. It is widely used by both developed as well as developing nations in the world. Dubai is evolving as a major aluminum exporting destination, supplying aluminum products to destinations like Pakistan, India, Iran, Morocco etc. Dubai’s total aluminum export in 2009 was valued at US $ 650 million. (Dubai Chamber of Commerce, 2011)

Jewelries:

Dubai is one of the biggest jewelry trading centers in the world, dealing in all kinds of jewelries- gold, diamond and silver. Dubai is presently world’s 4th largest diamond trading hub with total amount of trade valued at US $ 35 billion. (Includes export, import and re export). In 2010 Dubai imported a total of 90 million carats of polished diamond, worth US $ 13.3 billion and exported 73.6 million carats of polished diamond, worth US $ 14.6 billion. It also imported a total of 50.4 million carats of unpolished diamond and exported 54.7 million carats of the same. The major trading partners for Dubai in diamond jewelries are India, Hong Kong, Belgium, Angola and Congo etc. (Israel diamond industry, 2011) Dubai is also a major gold export and re export center. Total value of gold traded through Dubai in 2010 was US $ 41.3 billion, up by 18% from the previous year. The gold imports increased by 1 % year on year to 707 million tones where as export were down by 8.1 % to 418 tones. Around 100 countries traded in gold with Dubai in 2010, India being the top trading partner followed by Switzerland. (Jewelry in Asia, 2011)

Singapore as an export hub

T

The following part of the blog will analyze Singapore as an export hub.

Economy of Singapore

Singapore, a small island nation with five million residents in South East Asia, is one of the biggest success stories in Asia. After getting freedom in 1963, the tiny island state took strong initiatives toward industrialization and opening up of economy. In contrast to Dubai where oil played an important role in building up the economy, Singapore’s economy is built on technology and labor skills. During the time of 70's Singapore's focus on modern industries such as electronics, petrochemicals and precision machines coupled with foreign investment helped the tiny state to transform itself into an industrial nation. Its liberal economic policies, industrious and highly skilled workforce and other natural advantage such as vast seaports and strategic location helped it attract a huge amount of MNCs to have their base in Singapore along with large amount of foreign investments. From 1963 to present Singapore has recorded an average GDP growth of 7.9 %.

Today Singapore is considered as one of the most liberal states in the world enjoying high per ca pita income, state of the art infrastructure and a robust economy. It had successfully diversified into services sector and is the financial and export hub of South East Asia It is also considered as one of the most innovative, liberal and business friendly nations in the world where it takes only three days to start a business in, much lesser than the world average that stands at 34 days.

Exports

Singapore is one of the biggest export hubs of the world. Manufacturing coupled with export had played an important role in expanding Singapore's economy. In 2010 Singapore had done a total trade of US $ 661 billion, consisting of total exports of US $ 478.84 billion and imports of US $ 423.2 billion.(Ministry of trade, Singapore, 2011) Major export items are petroleum products, food and beverages, pharmaceuticals, chemicals, electronics, industrial machines etc. Major import items are chemicals, electronic parts, petroleum, automobiles, food and beverages etc. Major export destinations are Indonesia, Malaysia, China, EU, USA, Hong Kong, Japan etc. The following pie chart shows the percentage wise break up Singapore's export to various nations in 2010.

Fig 7: Percentage wise break up of major export destinations in 2010, Source: US department of state

Major importing destinations are EU, Malaysia, USA, China, Japan etc. The following pie chart shows the percentage wise break up of various importing destinations to Singapore, for the year 2010.

Fig 8: Percentage wise break up of major importing to Singapore in 2010, Source : US department of State

Emergence of Singapore as a trading nation

Brief introduction to economic growth since 1960

During early 60's Singapore was a distribution center for simple products in the neighboring region. During this period it was undergoing through a rapid growth of population along with high unemployment rate. This led the govt. taking reformatory majors for the economy and trade such as no restriction on MNCs, relaxing labor laws and immigration laws, providing incentives to industries, which eventually resulted in transformation of Singapore into an export oriented industrial state. Reformatory measures coupled with the arrival of MNCs and emergence of Singapore as financial hub helped successfully transforming Singapore into an export oriented, highly industrialized state. In shaping up the growth trajectory of Singapore MNCs had a very crucial role to play. By 1981, though MNCs accounted only 16.7 % of the total companies involved manufacturing sector, they were responsible for 42.8 % of total employment, 55.9 % of the total output and 67 % of export. Direct export to total sales was 73 % for foreign firms while 26.5 % for local firms.

Singapore's initial focus was on labor incentive manufacturing, but eventually economy was restructured to pave way for high skill and technology based industries. Govt. played an important role in economic re structuring by executing steps such as giving tax incentive for research and development, providing capital assistance etc.

Growth of Exports (1960-80)

During 1960, trade in Singapore consisted of re export of primary commodities like rubber, palm oil, coconut etc and distribution of manufactured goods to the neighboring states. In 1960 total amount of re exports was ten times higher than the domestic export. Over the period of time this trend started getting reversed and in 1974, for the 1st time total domestic export was more than the re export. From 1960 to 1980, the value of percentage of total export decreased drastically for products like wood, rubber, food, beverages, tobacco etc (Even though there was a reduction in the percentage of total exports, the absolute value of export increased for products like, food, beverages, rubber etc.); where as it increased exorbitantly for products like chemicals, petroleum, electrical machineries. The percentage of total export remained constant for paper, furniture, non electrical machineries etc. where as a very moderate increase was registered for non metallic minerals and metal products. There had also been a paradigm shift in export destinations of Singapore. From 1960 to 1980, the percentage of export to developed countries increased from 4% to 45%, where as for developing countries it decreased from 96% to 52 %.( a part of this can be explained from the fact that many of the neighboring economies like Malaysia, were growing fast, there by depending less on Singapore for their import requirements.)

Growth of Exports (1990- present)

By 1990, Singapore was among the most vibrant economies of the world. As an economy it had successfully transformed itself from a low skill, labor intensive economy to a, high skill, high technology and high value based one. Blessed with a burgeoning financial sector, it was an ideal export destination and a haven for foreign investors and MNCs. The paradigm shift in its economy was well reflected in its export structure also. From an export destination of labor intensive, low value products such as palm oil, textile, leather products, it had been transformed into an export hub of high value, high technology and capital intensive products such as , petrochemicals, precision machines, pharmaceuticals etc. During the 90's, lots of FTAs (Free Trade Agreements) were signed between the govt. of Singapore and various other trade partners such as USA, Japan etc. This resulted in higher profitability in the form of fewer tariffs along with better market access for the exporters in Singapore.

Singapore VS Dubai: as trading hubs

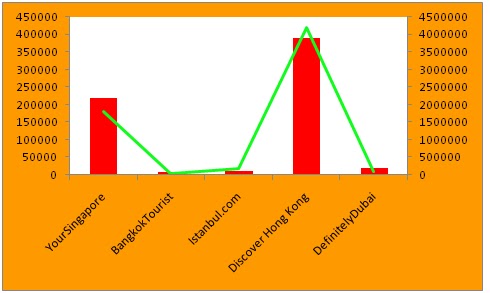

The following part of the blog will compare Dubai and Singapore as trade hubs, across various parameters such as strategic location, economy, ports etc, and based on this will score them in a scale of 0 to 5. Based on secondary resources, it will also try analyzing their future strength and will do a separate scoring for it. The following figure compares Singapore and Dubai in terms of their exports.

Fig 9: Comparison of annual exports of Dubai and Singapore, Source: Dubai chamber of commerce and Ministry of trade and industry, Singapore, annual statistics

At present there is a huge difference between Singapore and Dubai, with Singapore enjoying almost eight times the export of Dubai. But Dubai has ambitious plans to leapfrog itself from a regional trading hub to a global one and Singapore can be the source of some great insights, helping Dubai in its endeavor.

General Economic and Social Environment

The general economic environment is very essential for the success of a trading hub. There will be three sub categories under this- economic growth, physical and IT infrastructure and social infrastructure.

Economic growth: A stronger economic environment ensures; liquidity for business, ease of establishing and doing business, investments in infrastructure etc. Both Dubai and Singapore are economically well off, enjoying a high GDP growth and per capita income. The following figure does a comparative analysis of GDP growth of Dubai and Singapore.

The given figure shows Dubai’s vigorous growth in the early phase of 2000. This was the period when Dubai showed exorbitant growth, leapfrogging many of the fast growing economies in the world. By the 2nd phase of the decade growth had been very moderate for both the economies, due to global economic slowdown. Dubai has also been hit hard due to real estate bubble burst in the given period.

Infrastructure: - Both the cities have great infrastructure. Huge investments have been made by the respective governments in developing physical and telecommunication infrastructure. Both enjoy well developed transport facilities, state of the art road networks, wide range of hotels and resorts, high internet and telecommunication penetration etc.

Social environment: is another area, very significant for profiling a trading hub. A vibrant social environment helps in attracting a wide range MNCs and individual talent from all across the globe, which is very essential for the success of a trading hub. Both Dubai and Singapore have very vibrant and cosmopolitan culture, attracting a huge expatriate population and a wide range of MNCs. In order to judge them more precisely on physical infrastructure and social environment, the Mercer- Quality of living worldwide will be used. Mercer’s quality of living survey is released annually comparing 221 cities across 39 criteria- safety, education, hygiene, health care, culture environment, recreation, socio-political stability, public transportation etc. Cities are scored with respect to New York which has a score of 100. The following table shows the position of Dubai and Singapore along with some other major cities of the world, in the Mercer quality of living survey.

Based on Mercer’s ranking Singapore ranked 28 definitely has a considerable edge over Dubai, ranked 75.

On the Basis on the GDP growth rate (where both the cities are fairly at same level) and Mercer’s ranking, Singapore and Dubai had been allotted a score of 4 and 3 respectively.

Strategic location

Both Dubai and Singapore enjoys great strategic locations and are located in the midst of economically well off geographies; Dubai in the midst of rich gulf states and Singapore in the midst of South East Asian tigers. Now the following table will compare distance of Dubai and Singapore from some of the major nations/ geographies of the world.

Table 2: Distance of Singapore and Dubai(both air and sea) from major economies/geographies

Source: http://www.portworld.com/map/, timenddate.com

It could be seen from the table that other than some of the South East Asian locations and China, Dubai has an edge over Singapore in terms of both- aerial distance as well as distance via the sea. Hence Dubai gets a score of 5, whereas Singapore gets a score of 4.

Logistics

Another important parameter deciding the strength of a trading hub is its logistic system and the volume of cargo, which it can handle. Though both Singapore and Dubai have strong air and sea logistic facilities, Singapore seems to have an edge on Dubai in terms of resources and the volume of cargo it handles annually. Singapore port, a term used for the collective ports and terminals situated in Singapore, is one of the busiest ports in the world. In terms of TEUs it is the world’s busiest port handling 28.4 million TEUs in 2010. (According to a latest report published by Shanghais Municipal Corporation, Shanghais has surpassed Singapore as the busiest port, handling 29.05 million TEUs, annually) On the other hand the Jebel Ali Port, the main port based in Dubai, has a strong regional significance, but at a present capacity of 11.6 million TEUs in 2010, it is far behind the ports of Singapore and China. The following figure will do a comparative analysis of Jebel Ali port and Singapore port, over the past few years.

Fig 11: Comparative analysis of Singapore ports and Jebel Ali port in terms of million TEUs

Singapore is slightly behind Dubai, in terms of air freight. Its Changi airport is served by 17 freight carriers, connecting Singapore to 60 destinations across 30 countries. It has an annual capacity of 3 million tones and had handled 1.8 million tons of cargo last year, against 2.2 million tons handled by Dubai International Airport. Over all on account of much higher annual capacities of its port Singapore has a considerable advantage over Dubai, in logistics and hence a score of 5 had been given to Singapore and a score of 4 had been given to Dubai.

Govt. Policies and Ease of doing business

An area of great significance can be the govt. policies of a place. Govt. policies in the form of custom duties, tax benefits, and tariffs should be liberal enough to facilitate trade in a geographical location. Singapore is one of the most liberal and open economies in the world. The tariffs are almost negligible, while it has signed a plethora of FTAs with countries- USA, Japan, Jordan, European countries such as Norway, Switzerland, China, GCC countries etc. Though it does not have zero percent income tax as Dubai, but has a very competitive tax regime. The corporate tax is capped at 17% and personal income tax at 20%, with no tax on the 1st US $ 16, 350 of income. Dividends are not separately taxed. It has very few excise and import duties. Excise duties are charged on tobacco, liquor and petroleum products where as import duties are charged on tobacco, liquor, petroleum and automobiles. As discussed earlier Dubai also has a very liberal trade policies in the form of free tax regime, low custom duty of 4% and almost no tariffs.

As much over all ease of doing business is concern Singapore is much ahead of Dubai. According to the survey “Ease of doing business” (an initiative taken by World Bank group, that ranks various economies on various parameters- ease of starting a business, getting construction permits, registering properties, getting credits, paying taxes, closing business etc) Singapore holds the 1st position. Dubai (UAE) has an overall 40 position. The following table gives rank of some of the prominent economies in the survey:

Table 4: Ease of doing business ranking of some selected economies

Based on performance of these two economies- for the parameter, govt. policies and ease of doing business- a score 5 had been given to Singapore and 3 had been given to Dubai.

Overall Ratings

The following chart compares the score of Singapore and Dubai across all the parameters.

Fig 12 : Comparative analysis of Singapore and Dubai across the given four parameters.

From the chart it is evident that other than strategic location, Singapore has a strong edge over Dubai across all the parameters- General economical and social environment, logistics and govt. policies and ease of doing business. Singapore’s strength over Dubai can also be explained by the fact that as Singapore’s involvement with export goes much longer than Dubai. Singapore had been an exporting nation since 1960’s and since the city state was devoid of natural resources, the govt. paid huge attention to export and manufacturing sector. In contrast to this Dubai had been an oil rich state, with oil contributing more than 50 percentage of GDP till 1980s. During the time of late 90s, in the light of depreciating oil reserves Dubai started taking strong initiatives towards economic diversification. Hence Dubai’s emergence as a regional trading hub is much recent phenomenon. Though Dubai is still a regional trading hub, it has ambitious plans of transforming itself into a global trading center. Singapore with a much intense learning curve in this field can be a great role model for Dubai. The concluding part of the blog will discuss the way ahead for Dubai, as a trading center.

Recommendations for Dubai

Dubai is seeking huge investments in transforming itself into a global export/import center. Not only is the Emirate taking strong steps to market itself as a global brand, but also investing hugely in up scaling its existing capacities. The following part of the blog will be discussing few areas, where Dubai can take strong steps to escalate its status

Boosting of domestic export

Dubai is still, more of a re export center. Out of the total export of US $ 58 billion in 2010, re exports at a value of US $ 40 billion accounted more than 2/3 rd of exports. In contrast to this Singapore has a very healthy mix of export and re export. The value of export in 2010 was US $ 478 billion and re export was US $ 230 billion. In order to become a global trading center Dubai needs to add on upon its existing manufacturing capabilities. Even during 60s Singapore itself was a re export center, but sooner with the help of strong govt. initiatives it developed a strong manufacturing sector, thereby boosting domestic trade. Dubai needs to undergo same sort of transition.

Signing more FTAs

In contrast to Singapore that has a wide range of trade partners ranging from Australia, USA, EU to neighboring nations such as Indonesia, Malaysia etc, Dubai’s trade is mostly restricted to the MENA region and neighboring India. Dubai needs to diversify its current portfolio of trading partners by signing more FTAs with nations all around the globe.

Dubai can become the next Oil trade Hub

According to an analysis done by Reuters, in the midst of new oil refineries coming in Middle East and neighboring India, Dubai can see a surge in oil trading. Strategically located in Middle East and having extra oil storage capacity that Singapore lacks, Dubai can even surpass Singapore in ten years time. By 2012, petroleum output is expected to increase to 9.6 million barrels per day, taking export to 3.1 million barrels a day. Though this surge can surely influence Dubai’s profile as a trading hub, much depends on Emirates capability to bring in more transparency and strong regulations and financial instruments. Oil traders need sophisticated hedging instruments to protect their cargo, but such instruments are almost absent in the Middle East region. Hence Dubai need to take pro active steps in this direction. (Reuters, 2010)

Dubai is presently undergoing through an exciting phase in its transformation from an oil rich gulf state to a diversified economy. Dubai started its economic diversification in the late 90s and so far its efforts have paid off well. It had made remarkable success in tourism, trading, real estate etc. But there are still scopes for lot of changes. So far in a decade time it’s the leading trading hub of an oil rich and geo politically significant region. Becoming a global player requires an all new set of games and Dubai seems ready for the challenge. Dubai’s maneuver in the form strong investments in its branding, port and airport expansion, economic diversification and industrialization signals about its great ambitions. Much depends on how things will take turn in the coming time. The next two decades will tell about this.

References

3>